Reasons to Be Bullish on the Ethereum Ecosystem

Adoption of Blockchains

Blockchains are new, decentralized platforms that have opened the path for the next generation of internet applications. Similar to Web2, trillion-dollar companies will be built on these competing infrastructures – but which blockchain will prevail? In this blog post, I’ll show you why Ethereum has the strongest fundamentals as a Layer 1, and how Ethereum Sidechains and Layer 2 solutions are significantly contributing to the Ethereum ecosystem.

Evaluating Ethereum’s Fundamentals

For any Layer 1 blockchain, security is the top priority because blockchains are ultimately settlement layers for value. To have security, a blockchain’s native asset needs to be strong as it is used to incentivize validators running the network. You need assurances that your transactions on the network are final and legitimate, and that there are no chances of reversibility from bad actors. Ethereum’s native asset, ETH, captures the features of hard money, and it has been very valuable in terms of increasing the security of Ethereum and, indirectly, the whole Ethereum ecosystem.

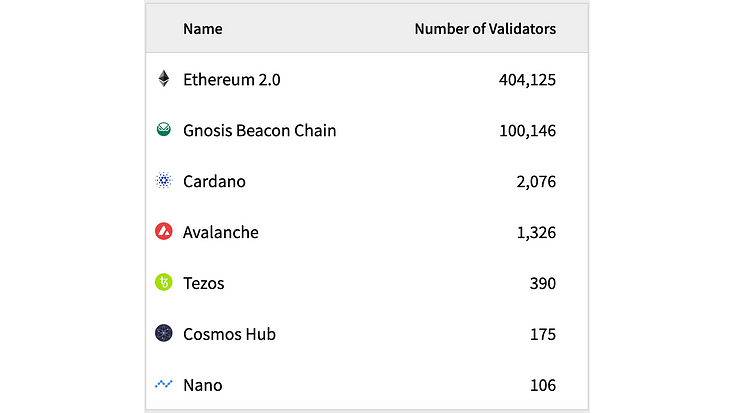

Layer 1 blockchains also need to be sufficiently decentralized. No single actor or entity should have control over the network and anyone should have the ability to participate in validation (via mining/staking) or maintaining the ledger (via running a node). If you can’t run a node on a blockchain, it’s permissioned, and you may as well just use Amazon Web Services. As you can see in the node and validator count of major Proof of Stake blockchains on Stakers.info below, Ethereum currently dominates the number of validators.

Once security and decentralization are taken care of, it means that a blockchain is safe and reliable for developers to build on. You can trust that the network won’t shut off, roll back, or get hacked. A robust developer ecosystem is essential for a Layer 1 blockchain because, without developers, there are no applications, and without applications, there are no users. Below is a snapshot of the monthly active developers across different blockchains from Electric Capital that shows how Ethereum’s developer network effects have grown over the last seven years. For any other blockchain to reach Ethereum’s level of maturity, it is going to take time, and there is no shortcut.

Ethereum Sidechains

Sidechains are standalone chains that run in parallel with Ethereum and do not inherit its security properties. They work by connecting to Ethereum through a two-way bridge that facilitates the transfer of assets, but they have their own validator sets and consensus protocols that are often designed for the efficient processing of transactions.

Most Sidechains are based on the Ethereum Virtual Machine (EVM), which is the computation engine for Ethereum. EVM-compatibility means that developers do not need to make any changes when they want to use their Dapp from Ethereum, it’s simply a matter of deploying the same smart contract written in Solidity. Developers can also take advantage of Sidechains to let their users enjoy lower gas fees and faster transactions, especially if the Ethereum Mainnet is congested.

Ethereum already has a high success rate with Sidechains. For example, on Ethereum Atlas, there are over 60 EVM-compatible chains. Despite trade-offs around security, all these Sidechains use Ethereum to generate their assets, bridge their assets back and forth, and checkpoint all sorts of activities, driving lots of value to the Ethereum ecosystem. Popular Sidechains include Polygon PoS, SKALE, and Gnosis Chain.

Ethereum Layer 2 Solutions

Layer 2 solutions are separate chains that extend Ethereum and inherit its security properties. They work by compressing batches of transactions and submitting them to Ethereum Layer 1 in order to ensure similar security and decentralization guarantees.

Narratives aside, the reality is that transaction fees on Ethereum’s Mainnet are getting too expensive because of the high demand. By executing transactions outside of Ethereum Layer 1, Layer 2 solutions are able to achieve greater scalability, which means increased transaction speed (faster finality) and transaction throughput (higher transactions per second), without sacrificing security and decentralization.

Rollups are currently the preferred Layer 2 solution for scaling Ethereum that bundles hundreds of transactions into a single transaction on Layer 1, splitting the Layer 1 transaction fees across every user in the rollup. Generally, there are two different approaches to rollups, Zero-knowledge (ZK) rollups that use validity proofs (transactions are posted with a cryptographic proof that they are valid), and Optimistic rollups that use fraud proofs (transactions are posted with an assumption that they are valid, but can be challenged if necessary). Today, there is a vibrant ecosystem of Layer 2 solutions built around Ethereum such as Arbitrum, Optimism, and StarkWare, all of which prove that Ethereum can scale on Layer 2.

The Ultimate Settlement Layer

Security, decentralization, and a robust developer ecosystem are fundamental for any Layer 1 blockchain to become the secure, public settlement layer for Web3. For all three attributes, Ethereum is way ahead of anyone else. When Sidechains and Layer 2 solutions checkpoint or roll up to Ethereum, they also benefit from Ethereum’s strong property rights, and strong property rights are what makes this whole industry work. I believe that eventually, business activities will move to various execution environments like Ethereum Sidechains and Layer 2 solutions, and Ethereum Layer 1 is going to emerge as the ultimate settlement layer.